In order for our team at Ryans to manage and discuss your business’ affairs with HMRC, we need to be registered with them as your tax agent. The quickest and easiest way to do this is to notify HMRC via your online Government Gateway account.

Please see our simple instructions below on how to do this:

1. Sign into Your Government Gateway Account

Visit the HMRC online services website and sign in to your Government Gateway account. If you haven’t yet set up an ID for your personal taxes, you can create an account online.

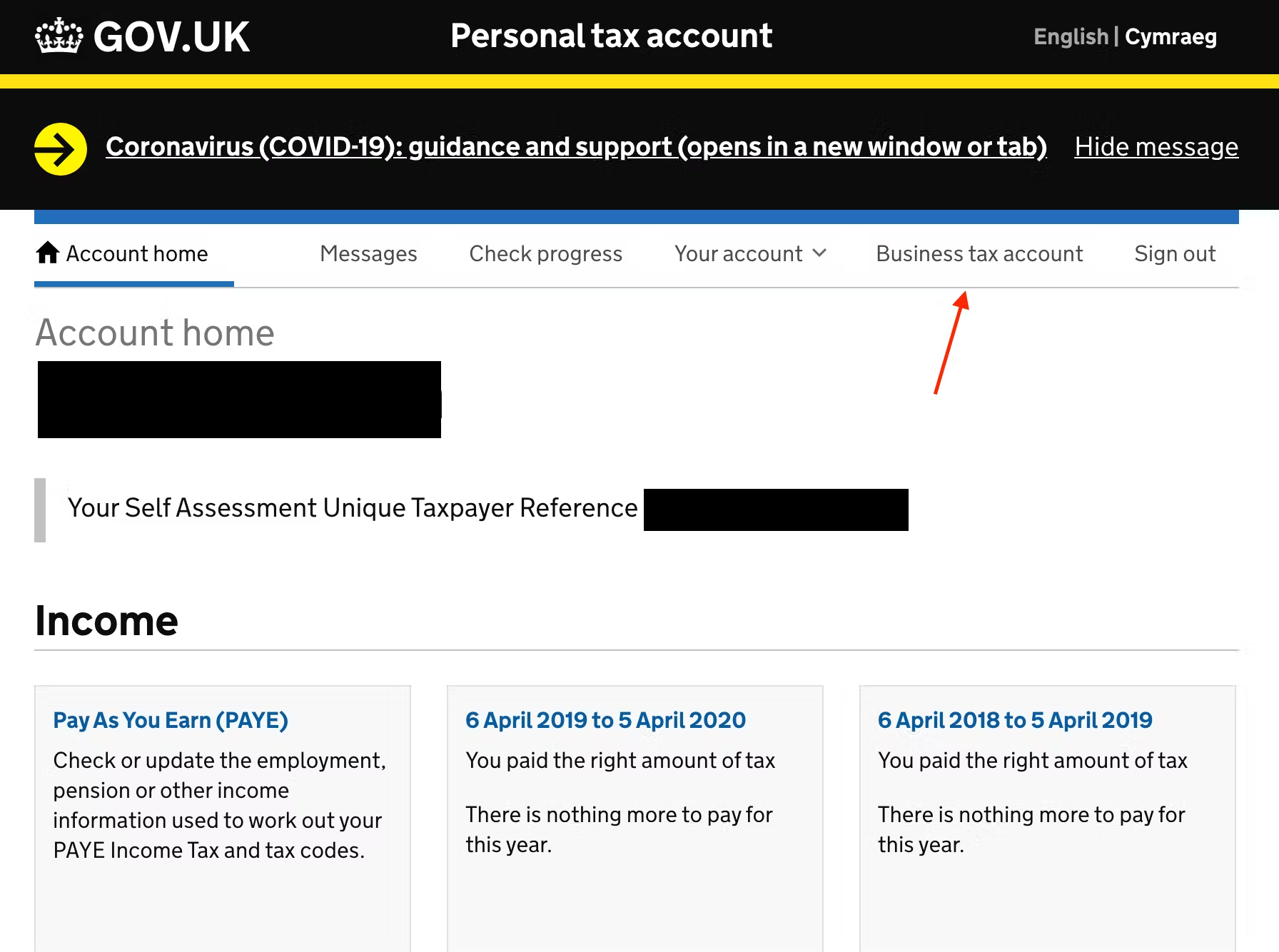

2. Select ‘Business tax account’

Click on ‘Business tax account’ from the menu at the top of the page.

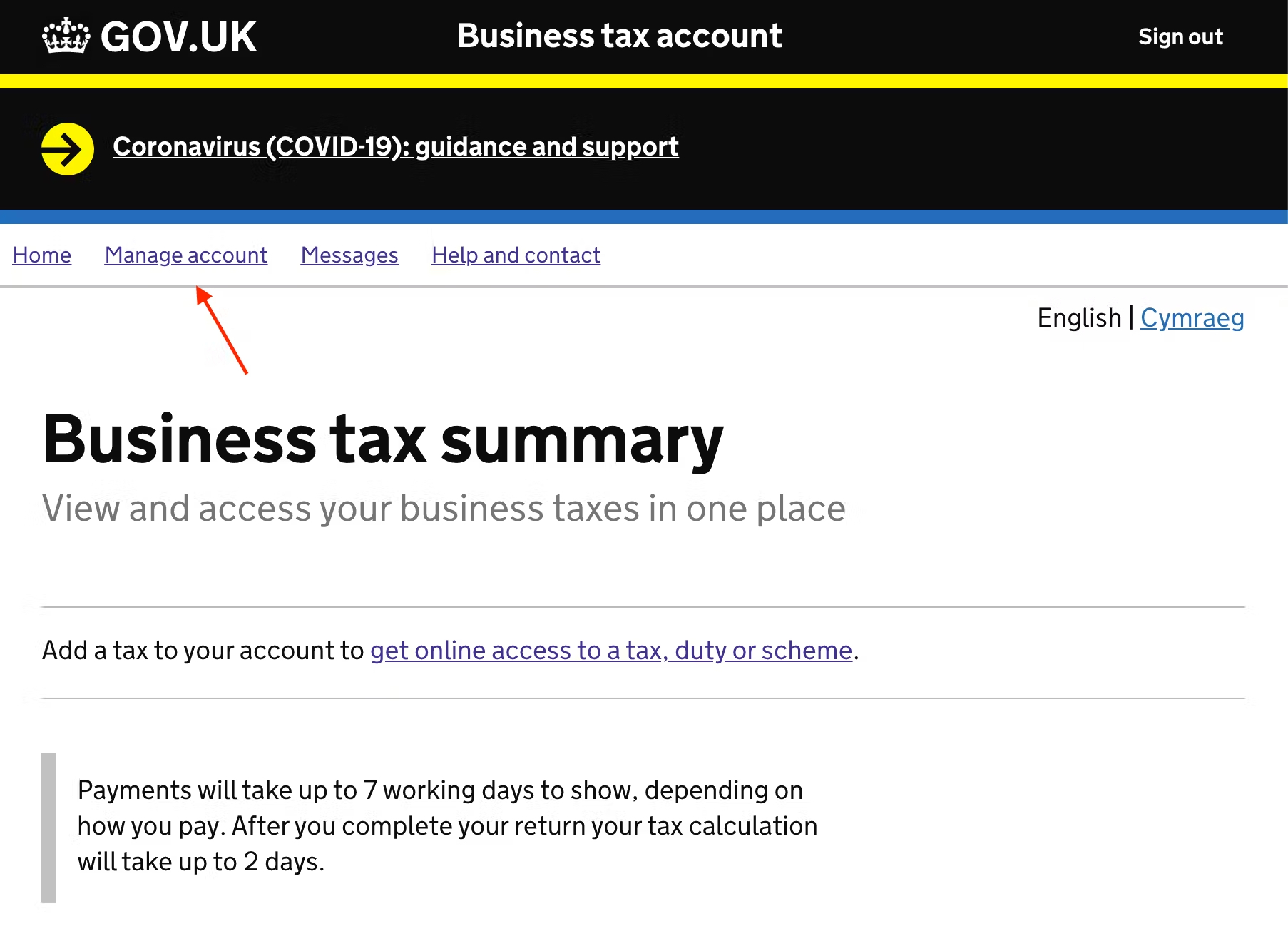

3. Select ‘Manage account’

Click on ‘Manage account’ from the menu bar.

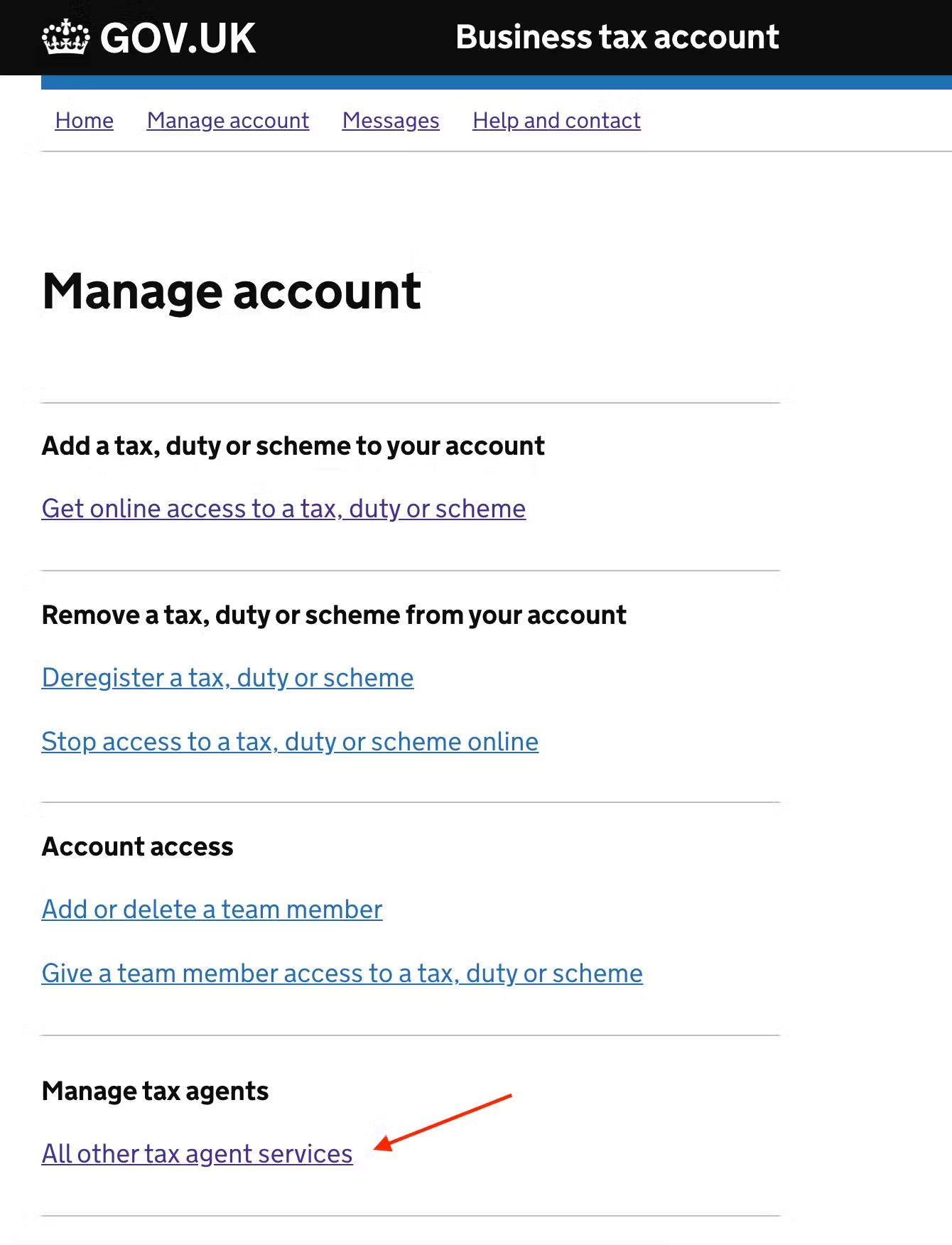

4. Select ‘All other tax agent services’

Scroll down to the section on the page that says ‘Manage tax agents’. Beneath this, you’ll see a link to ‘All other tax services’- click this.

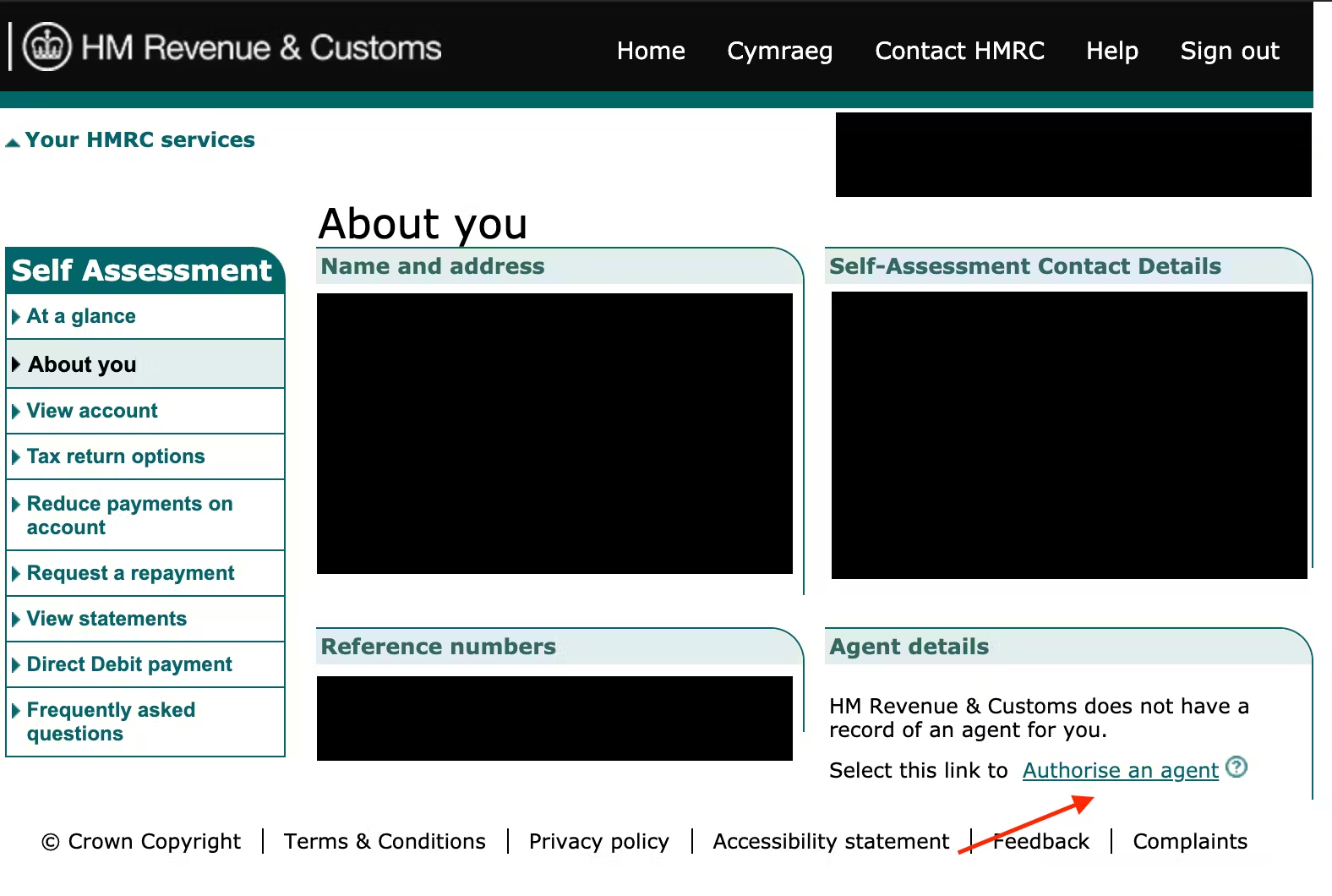

5. Authorise an agent

You will then be taken to an ‘About you’ page. Under a section that says ‘Agent details’, click on the link that says ‘Authorise an agent’.

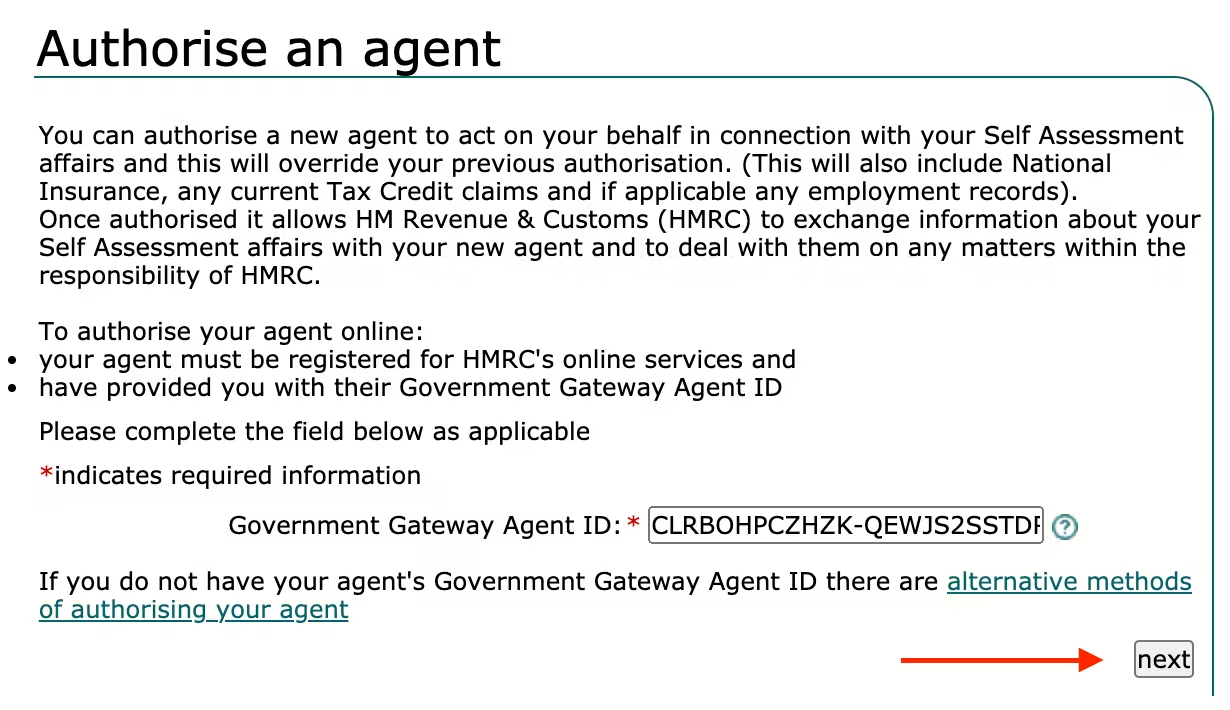

6. Input the Agent’s Government Gateway Code

Your agent should have provided you with their code. Enter this into the correct field and press the next button. Please note, an agent code looks like this: CLRBOHPCZHZK-QEWJS2SSTDRD

7. Confirm Agent Details are Correct

Finally, double check to make sure all of your agent’s details are correct. Once you’re happy, tick the checkbox to confirm that your agent may act for you in respect to Self Assessment and click the next button.

And that’s it! Now you can sit back and relax, knowing our team of experts can manage your personal tax on your behalf!